If you received the letter by certified mail from the IRS Automated Collection Service, mail it back to the Post Office Box shown in the upper right hand corner of the notice. If the IRS disallows your claim you will have the right to appeal at that time. Your case is closed as far as any determination about how much you owe, so there is nothing for you to appeal at this point. At the hearing, the IRS will then discuss with you the merits of your offer in compromise, or a payment agreement, or whether you debt can be treated as uncollectible. Refer to Publication , Collection Appeal Rights to review your appeal rights. Even though tax laws state that a Collection Due Process Hearing must be requested within 30 days after the final notice is sent, IRS administrative rules allow you up to one year to file the appeal.

| Uploader: | Gabei |

| Date Added: | 2 September 2008 |

| File Size: | 64.48 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 72987 |

| Price: | Free* [*Free Regsitration Required] |

Prepare the Form The IRS cannot levy with just this notice. To do to this, reference the Final Notice of Intent to Levy — it will state the type of 121153 you owe for example, income taxesthe IRS tax form that you filed creating the debt i. This field is for validation purposes ir should be left unchanged. Do you live outside of the Greater Cincinnati area? How can I appeal?

What Is a Collection Due Process Hearing With the IRS?

Appeals will evaluate the financial information and your unique circumstances to try to reach an agreement with you regarding payment of the liability.

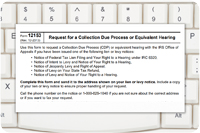

If the IRS disallows your claim you will have the right to appeal at that time. What you give up urs filing late is the ability to have a U. You should request a CDP hearing using Form if you feel the levy is inappropriate. Because of that, I suggest filing the appeal with proof of mailing and delivery.

Collection Due Process (CDP) FAQs

Next, you will find that the IRS requests that you tell them what taxes you are appealing. Contact the Collection function to discuss your situation and your payment options.

The Form permits you to tell the IRS that there are better options to levying your accounts. That consists of a hearing, a hold on collection irx levy, and a solution to your taxes that does not include levying your accounts and assets. At the hearing, the IRS will ids discuss with you the merits of your offer in compromise, or a payment agreement, or whether you debt can be treated as uncollectible. Note that you must submit new information the IRS did not previously consider in order to have an audit reconsideration.

They intend to levy Certain Assets. Refer to Publication In the space below, please do your best to describe how I can help you. Pay the amount due in full and file a claim for refund. The Final Notice of Intent to Levy should have come with a package of inserts, one of which would be the Form for you to use in filing your IRS-stopping appeal.

If it is from a Revenue Officer, send it back to her. Use as much detail as possible to state your issues. Publication will help you decide which is best for you. However, as explained in Publicationin a CDP hearing Appeals can only discuss the existence of or amount that you owe under very limited circumstances.

What Is a Collection Due Process Hearing With the IRS? | Nolo

Tell the IRS what you want by checking the box for appeals consideration of the options that may apply to you: You should request a CDP hearing using Form if you feel the lien is inappropriate.

However, you do have three options to have your case re-opened so the IRS can consider whether you owe any additional amounts: Or maybe an IRS Revenue Officer makes an unannounced visit to your home or work, and after introductions, hands a letter to you. Remember, you are requesting better options to levying your accounts, and while the IRS considers and negotiates those options with you, levying your accounts should be on hold.

However, as explained in Publicationin a CDP hearing Appeals can only discuss the existence of or amount that you owe under limited circumstances. To accomplish this, within 30 days, you have the legal right to file a Collection Due Process appeal.

Before the frm, the IRS will need a financial statement from you detailing your income, living expenses, assets and liabilities to negotiate your resolution. To include this information with your appeal, in addition to the supporting documents these forms request, will greatly reduce the amount of time Appeals needs to make its decision in your case.

Comments

Post a Comment